When preparing to start your university journey, many factors come into play — from choosing your courses to finding the right accommodation. However, one aspect often overlooked by many students is the type of insurance required to ensure a smooth university experience. Understanding what kind of insurance you need to matriculate at a university is crucial because it not only protects your health and personal belongings but also ensures compliance with university policies and state regulations.

In this article, we will explore the different types of insurance that are typically required or recommended for students entering a university. This guide will cover:

- Health Insurance

- Personal Property Insurance

- Liability Insurance

- Travel Insurance (for International Students)

- Tuition and Fee Insurance

By the end, you will have a complete understanding of what each type of insurance covers, why it’s important, and how to choose the right plans to ensure a worry-free university experience.

1. Health Insurance: A Necessity for All Students

What Is Health Insurance?

Health insurance is a contract that requires your insurer to pay some or all of your healthcare costs in exchange for a premium. Most universities require students to have health insurance as part of their matriculation process. This insurance is meant to cover medical expenses, whether for routine checkups or emergency treatments, and to safeguard students from high out-of-pocket costs.

Why Is Health Insurance Important?

Health insurance is crucial for students for several reasons:

- Access to Healthcare: It allows you to access necessary healthcare services without financial strain.

- Emergency Situations: It provides coverage in the event of accidents or sudden illnesses.

- Mental Health Support: Many health insurance plans include mental health services, which are essential given the high stress levels many students experience.

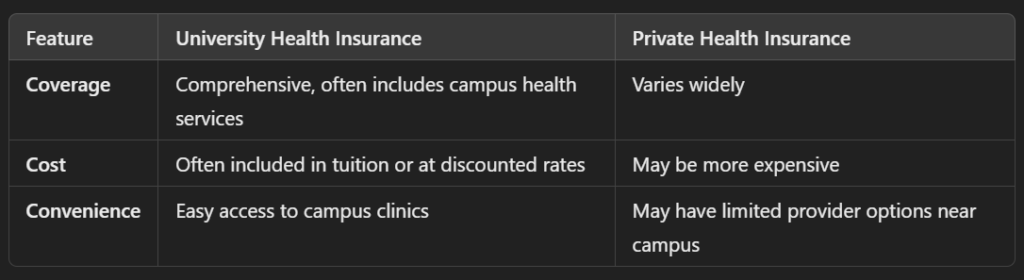

University Health Insurance vs. Private Health Insurance

Most universities offer their own health insurance plans, which are tailored to meet the specific needs of students. Alternatively, students may opt to use private health insurance plans. Here’s a comparison:

Waivers for Health Insurance

If you already have a health insurance plan that meets the university’s requirements, you may be eligible for a waiver. This means you won’t need to purchase the university’s health insurance. Be sure to check with your university’s health services department for specific waiver policies.

2. Personal Property Insurance: Protecting Your Belongings

What Is Personal Property Insurance?

Personal property insurance, also known as renters’ insurance, covers your belongings, such as electronics, books, clothing, and other personal items, against theft, fire, or damage. As a student, you’re likely bringing several valuable items to your dorm or apartment, making this type of insurance essential.

Why Is Personal Property Insurance Important?

- Theft Protection: Dorm rooms and shared accommodations can be vulnerable to theft. Personal property insurance ensures you are compensated if your belongings are stolen.

- Natural Disasters and Accidents: It covers damage from events like fires or flooding.

- Affordable Premiums: The premiums for personal property insurance are usually quite low, making it an economical way to protect expensive items.

What to Consider When Choosing a Plan

When selecting personal property insurance, consider the following factors:

- Coverage Amount: Ensure the policy covers the replacement cost of your items.

- Deductible: Choose a deductible amount that balances affordability with sufficient coverage.

- Off-Campus Coverage: If you’re living off-campus, make sure your plan covers theft and damages in your specific location.

3. Liability Insurance: Covering Unexpected Damages

What Is Liability Insurance?

Liability insurance protects you in case you are found responsible for causing injury to someone else or damaging their property. This type of insurance is less common among students but can be very useful, especially if you live in shared accommodation.

Why Is Liability Insurance Important?

- Personal Injury: If a visitor is injured in your dorm or apartment, liability insurance can cover their medical expenses.

- Property Damage: It also covers damages you might unintentionally cause to another person’s property.

- Legal Costs: Liability insurance can help cover legal fees if a lawsuit is filed against you.

University Requirements for Liability Insurance

Some universities, especially those with campus housing, may require liability insurance. This ensures that students can cover any damages they may accidentally cause in shared spaces or to university property.

4. Travel Insurance: A Must for International Students

What Is Travel Insurance?

Travel insurance is designed to cover unexpected costs that may arise when traveling to or from your university. It is especially important for international students, as it covers not only trip cancellations and delays but also medical emergencies abroad.

Why Is Travel Insurance Important for International Students?

- Medical Emergencies: Travel insurance provides coverage for medical treatments that might not be covered by your regular health insurance while abroad.

- Trip Cancellations: It can compensate you for non-refundable travel expenses if your trip is canceled for a covered reason.

- Lost or Delayed Luggage: If your luggage is lost or delayed, travel insurance can reimburse you for the value of your belongings.

What to Look for in a Travel Insurance Plan

When choosing a travel insurance plan, focus on the following:

- Medical Coverage: Ensure it covers emergency medical expenses, including evacuation and repatriation.

- Trip Interruption and Cancellation: Check if it covers cancellations due to unforeseen events, such as illness or travel bans.

- Baggage and Personal Effects: Choose a plan that covers lost, stolen, or delayed baggage.

5. Tuition and Fee Insurance: Protecting Your Investment

What Is Tuition and Fee Insurance?

Tuition insurance, sometimes called tuition refund insurance, reimburses you for lost tuition costs if you need to withdraw from school due to illness, injury, or other covered reasons. With the high cost of university education, this type of insurance can be a smart investment.

Why Is Tuition and Fee Insurance Important?

- Unexpected Withdrawal: Life can be unpredictable. If you or a family member experience a health crisis, this insurance can prevent financial loss.

- Peace of Mind: Knowing that your tuition investment is protected can reduce stress.

- School Policy Limitations: Many universities have strict refund policies. Tuition insurance ensures you are not left without recourse in case of an emergency.

What to Consider When Choosing a Plan

When selecting tuition insurance, pay attention to:

- Coverage Limitations: Ensure the plan covers the full tuition amount.

- Valid Withdrawal Reasons: Check the plan’s list of covered reasons for withdrawal.

- Exclusions: Understand what the plan does not cover, such as academic dismissal or voluntary withdrawal.

Conclusion: Choosing the Right Insurance for a Secure University Experience

Understanding and selecting the right insurance before matriculating at a university is crucial for ensuring a safe and secure college experience. Health insurance is typically a requirement, while personal property, liability, and travel insurance provide additional layers of protection. Tuition and fee insurance can safeguard your educational investment.

Before making your decisions, research the specific requirements of your university, evaluate your own needs, and compare different insurance plans. The right insurance coverage will allow you to focus on your studies and enjoy your university journey with peace of mind.

By taking the time to secure the appropriate insurance, you are not just fulfilling university requirements but also making a wise investment in your personal safety and academic future.